Are Financial Services Leads Worth the Investment?

I hope you enjoy this blog post. If you want Hello Bar to grow your leads, click here.

Author:

Ryan Bettencourt

Published

July 9, 2024

Where do successful financial advisors get their financial services leads?

Wealth is all around, especially lately.

According to the USA Wealth Report 2024, between 2013 and 2023, 5.5 million people turned millionaires which amounts to about 62% growth rate.

This means that almost 24.5 million millionaires live in the US. And to manage their wealth, you would need a lot of financial advisors.

Surprisingly, the US Bureau of Labor Statistics listed 218,050 Americans who listed “personal financial advisors” as their profession.

Using simple averaging, we can conclude that every financial advisor could have more than 100 clients if they pitch well.

If have a growing financial services firm, you want to learn all about financial service leads and how to convert them.

In this post, we’ll discuss actionable and proven lead-generation strategies to attract, nurture, and convert financial services leads for your business.

Let’s dive right into it.

Referrals or Lead Generation Services?

Many financial advisors seem to have a problem getting enough leads to talk to every month.

Despite the abundance of wealthy Americans, getting even just one to sit up front to listen to a sales pitch remains a challenge.

Eventually, many realize that good old analog networking is the best way to get leads.

Referrals from clients, friends, and family still work best at getting that crucial contact information.

While reliable up to a certain point, referrals are certainly unsustainable.

What happens when the circle closes in?

Getting a monthly quota of new referrals will eventually (maybe even quickly) dry up even the most extensive personal networks.

Advisors will now have to face what they see as the next best option: get leads the easy way.

Getting exclusive financial advisor leads from a digital agency can fill up those client information sheets in a hurry.

That is if you don’t mind paying for the service, which can substantially eat up profits. Then again, that’s assuming some of the leads pans out.

What’s Wrong With Outsourcing for Financing Services Leads?

This isn’t saying outsourcing from financial lead generation companies is a bad idea.

It will definitely provide the leads at the rate required.

However, the list does not guarantee the quality of leads, nor will it ensure that the contact person will respond positively or respond at all.

What’s more, profitability will depend greatly on how much each lead costs.

Many financial advisers will realize that getting investors to respond to a cold call is nearly impossible.

Understandably, people with money to invest do not go around advertising the fact.

It’s not hard to sympathize with an investor who isn’t comfortable discussing business finances with a total stranger over the phone or through email.

Why Not Generate Your Own Leads?

Sending out financial services leads may offer a short-term solution in getting the needed numbers.

However, these leads won’t help much to improve conversion rates or even to get the foot in the door.

Instead of paying for a list that a competitor possibly also paid for, why not try inviting prospective clients to visit you and see for themselves what you offer?

In order to attract investors, you’ll need a working website that features your philosophy and the services offered. This can be done by partnering with a white label marketing services agency to ensure a professional and polished online presence.

You’re not looking for haphazard investors that prefer similarly reckless financial advisors.

You want to go after the ones who perform due diligence and ask a lot of questions.

That’s because you know that once you manage to answer their concerns, they will be happy to entrust their resources to you.

Most cautious investors perform their own research and won’t hesitate to visit an advisor’s website.

Depending on the impression gathered from the visit, the investor will either want to learn more or won’t come back again.

Read More: 10 Best B2B Lead Generation Strategies

Get Investors to Visit Your Website

This is why having a complete website is key.

Information contained there can help them see how your organization differs from the others.

They will also get to get an idea of how recent performances turned out.

As careful investors will also look at your competitors’ websites as well, it pays to have your site easy to navigate and contains essential information.

In order to get people to appreciate your content, you’ll need site visitors.

This means good, resourceful, and informative content.

These are the posts that pop up on search engines organically when people have a question or look for a related topic.

Some of the suggested basic content that can help a site attract visitors and generate financial services leads include the following topics:

- A basic rundown on why investors could use help from financial advisors

- What your company offers and what sets it from the competition. This includes some tangible numbers that show how well you made it during the last fiscal year.

- A profile on the current business climate in your area, and why it’s good to invest now.

- Investing 101 for beginners (who are more likely to shop around for services) or Investing 102 for those who have more to spare.

Keep in mind that content covering these topics and others should be written clearly and have the target audience in mind.

Everybody wants to be witty and all, but eventually people come to your site with an objective in mind.

Try not to lose that objective for the chance to be funny or hip.

5 Financial Service Lead Generation Strategies

So far, we’ve seen that generating financial services leads is crucial for growing your business and securing a steady stream of qualified leads.

Now, let’s explore five effective tips for generating leads for your financial services company.

Attract New Leads with Search Engine Optimization (SEO)

In the previous section, we highlighted the need to have your own website.

However, you should optimize it to increase visibility when potential clients are searching for financial services providers online.

You can start by creating blog posts targeting long-tail keywords that reflect specific financial needs or questions. Here are some examples:

- Best investment options for someone in their 30s

- Best budgeting app for couples

- How to financially plan for early retirement

Additionally, you should create high-quality, informative content that naturally incorporates your target keyword.

Consider this. In 2023, 58.67% of the global web traffic came from mobile devices. This clearly means that if you want more prospects to visit your website, it needs to be responsive and mobile-friendly.

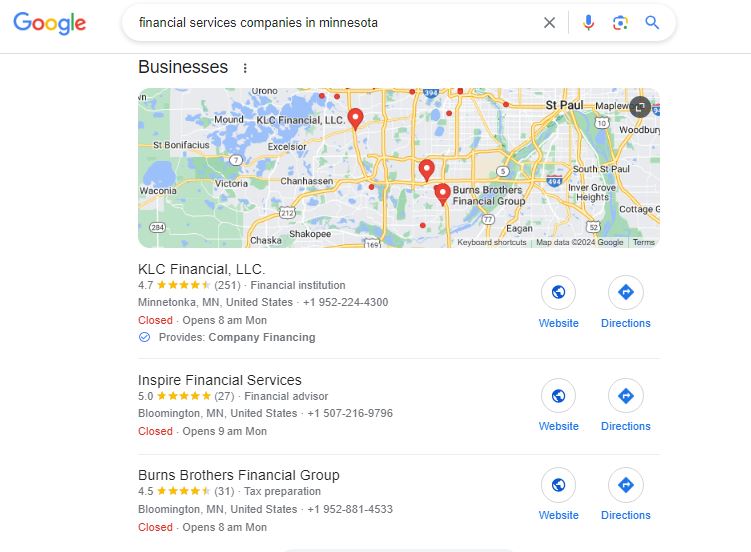

Consider Local SEO

Besides gaining a global reach, you shouldn’t underestimate the power of local SEO.

It can help you generate financial services leads in your region.

For instance, if potential leads in Minnesota search for financial services providers in that location, here’s what they’ll likely find something like this in the search results:

Image via Google

That being said, the following local SEO strategies can help in generating leads:

- Claim and optimize your Google Business Profile listing.

- Ensure consistency in your business name, address, and phone number.

- Publish client reviews on your website.

- Highlight your involvement in community events.

Offer Free Consultation

Potential leads want to experience your expertise firsthand without any financial commitments.

It allows you to establish trust, increasing the likelihood of conversion.

Here are some tips for lead generation through free sessions:

- Use a short survey to understand the needs of the prospective client, ensuring they align with your services.

- Use simple online appointment tools to make booking easy.

- Prepare a clear agenda and consultation materials like brochures and financial planning calculators.

- Conclude the session with clear next steps, such as downloading a resource or signing up for a specific service.

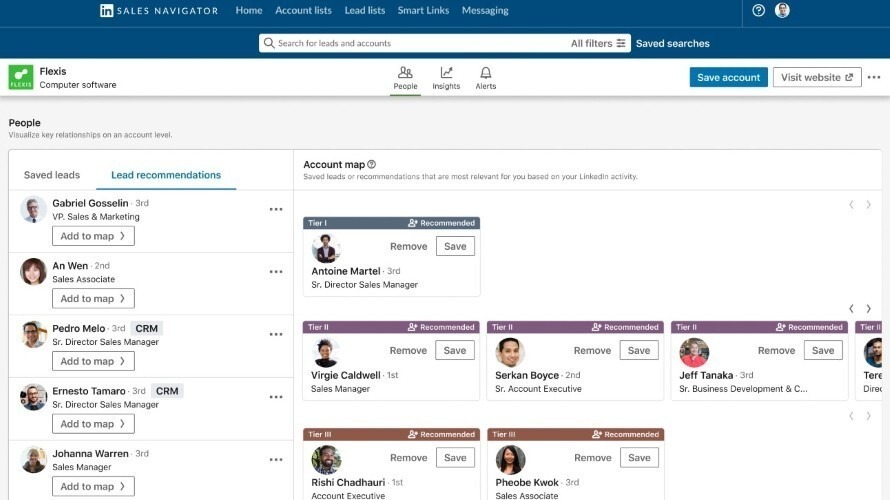

Optimize LinkedIn Profile

Besides being a platform for connecting with professionals, the right LinkedIn strategy can boost your financial services lead generation efforts.

Here’s how to leverage this platform effectively:

- Optimize your profile to clearly communicate your services and target audience.

- Share niche publications, financial tips, and market updates to showcase your knowledge.

- Engage in groups and conversations, establishing yourself as a thought leader.

- Use advanced search to find potential leads and connect with them through personalized outreach.

- Use LinkedIn Sales Navigator lead recommendation feature for more targeted prospecting.

This is how your account would look like:

Image via LinkedIn

Host Webinars and Virtual Events

Educational programs like webinars are a cost-effective way to find qualified leads.

They allow you to engage with a live audience, while capturing new leads through the registration process.

Consider using the tips below to effectively generate leads.

- Choose topics that are relevant to your specific audience.

- Offer practical, implementable advice.

- Include interactive components like polls and Q&As to gather insight into the needs of attendees.

- Send personalized follow-up emails, offering additional resources.

- Repurpose content into blog posts and short videos to generate more leads.

Invite Investors to Drop by and Say Hello!

Given today’s hypercompetitive marketplace, it doesn’t hurt to employ helpers.

If you manage to attract visitors due to your compelling, well-written content, you now have the chance to ask them for contact information if they:

- Want alerts for new content

- Would like to know more about the company

- Prefer to get in touch with a financial advisor now for immediate needs

- They would like to consider a future engagement

If you haven’t noticed yet, this is a way to generate financial services leads on your own, using your own resources.

Some visitors will need a gentle push to get them to leave information.

In this case, you may want to consider a helper such as a HelloBar to greet visitors and help capture leads.

Even better, it can also help convert leads as well.

The HelloBar can serve as a ticker for any ongoing promotions and upcoming deals.

It can automatically ask visitors to subscribe to the site, share their contact information, or even leave an inquiry.

A HelloBar ensures that every visitor gets a chance to learn more about your services the moment they step into your site.

HelloBar can be as upfront as a takeover, or as unobtrusive as a simple alert.

Whatever their appearance, they can help turn that visitor into a lead, or convert that lead into a customer.

FAQs

Q1. How do financial services leads differ from other types of leads?

Here are some ways financial service leads are different from other types of leads:

- Greater need for trust: Financial decisions are personal and involve a high level of risk. Thus, generating financial services leads require more trust before converting into clients.

- Lengthy sales cycle: Compared to other industries, financial services involve in-depth product education and needs assessment.

- Regulatory compliance: Several agencies regulate financial services companies in the United States. This affects how you can approach new leads and the kind of information to request.

Q2. How can investing in financial services benefit my business?

Investing in financial services can offer several benefits to your business, including:

- Access to funding: Financial advisors can help you identify and secure funding for business expansion and other capital-intensive investments.

- Risk management: Financial services can assist you in implementing strategies that mitigate business risk, such as protecting against foreign exchange rate fluctuations.

- Tax optimization: They can help you identify potential deductions and strategies for reducing your tax burden.

Q3. What factors should be considered when evaluating the quality of financial services leads?

Here are some factors you should consider when evaluating the quality of financial services leads:

- Their financial situation and how their goals match your services.

- The targeted marketing campaign that attracted these leads to your website.

- Did they provide complete and accurate contact info?

- The level at which they have engaged with your content.

Q4. How do I calculate the return on investment (ROI) for financial services leads?

When calculating ROI for financial services leads, you should consider lead generation costs, average client value over time, and conversion rates.

However, here’s a basic ROI formula:

[(Total client revenue from leads – Lead costs) / Total lead costs] x 100%

Q5. What are common challenges in converting financial services leads?

Converting financial services leads presents unique challenges such as:

- Competition: The financial services industry is highly competitive, so you have to differentiate your services to stand out.

- Price Sensitivity: You need to communicate all fees or commissions to potential clients, including the long-term benefits of your services.

- Understanding Client Needs: You have to accurately ascertain the financial situation of the prospect, their goals, and risk threshold. Recommending the wrong financial services can lead to dissatisfaction, hindering conversion.

Take Control of How You Generate Leads

Take control of your own lead generation processes.

Instead of depending on financial services lead generation companies, you can choose to spruce up your own website and make sure you have the tools to capture and convert leads.

Take a look at how HelloBar can help on your website.

Considering how reclusive and meticulous your market is, don’t approach investors haphazardly.

Let them come to you through quality content set on a very accommodating website.

Learn more about how HelloBar can help you increase up to 83% of your conversion rate. Visit HelloBar today and get started!